France's luxury property market shows signs of recovery for 2025

As 2024 comes to an end, the French luxury property market is showing promising signs of a recovery after a challenging two years. Isabelle DAHAN, editor-in-chief of Monimmeuble.com, highlights a growing sense of optimism: “Confidence is returning, particularly in the prestige sector, where buyers are attracted by larger, more exclusive properties, and lower borrowing costs are supporting high-end sales.”

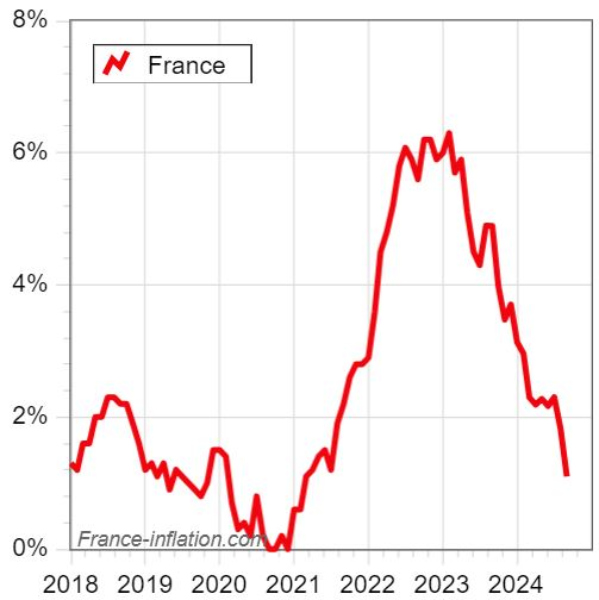

Luxury Buyers Benefit from Falling Interest Rates

The drop in interest rates has had a positive impact across the market, but especially at the higher end, where properties valued at €750,000 and above are seeing renewed interest. According to the Observatoire du Crédit Logement, interest rates have decreased from 4.20% in December 2023 to 3.62%, making high-value property purchases more accessible for affluent buyers. This has improved the purchasing power of luxury property investors, many of whom had delayed purchases during the market slowdown.

Shift in High-End Buyer Preferences

The pandemic has permanently changed the desires of luxury buyers. There is a strong demand for spacious properties that provide privacy, comfort, and flexibility for remote working. Prestigious homes with larger living areas, outdoor spaces, and proximity to nature are now particularly sought after. This trend has bolstered the recovery of the luxury segment, as affluent buyers look to upgrade to homes that fit their new lifestyle needs.

Regional Variations in the Luxury Market

While the overall market has begun to stabilise, there are distinct regional variations, especially in the high-end property sector. The provinces, and particularly coastal regions, are experiencing strong demand for prestige properties. PaP (Particulier à Particulier) has reported a surge in buyers for second homes in these areas, with wealthy families and executives leading the charge. Between April and August 2024, the volume of buyers in coastal regions grew significantly, with increases as high as 13.1% in August compared to the previous year.

In Île-de-France, however, luxury prices have experienced a sharper decline. In Paris, prestigious homes saw a price drop of 7.9% in the first quarter of 2024. Despite this, the market is showing signs of stabilisation, with prices expected to hover around €9,450 per square metre by August 2024. Investors are beginning to see this as an opportunity to acquire prime assets in the capital at slightly discounted prices.

High-End Rental Opportunities Boost Investor Interest

The prestige market is also benefiting from a surge in tourism, particularly in coastal and mountain regions. Investors are capitalising on the lucrative short-term rental market, which offers attractive returns. High-end properties in popular tourist destinations provide significant profitability, with less stringent regulations than long-term rentals. This makes luxury holiday homes an appealing investment for those looking to maximise returns.

Outlook for 2025

Although the worst of the property market downturn appears to be over, FNAIM cautions that a full recovery in the luxury sector may not arrive until 2025. While sales remain subdued, the stabilisation of prices and improving buyer sentiment suggest that the high-end market is on the path to recovery. Affluent buyers, many of whom are less impacted by rising interest rates, are likely to drive this revival, particularly as they regain confidence in the broader economic landscape.